Zhu Minshen's Top Group share prices continues to flounder despite TEQSA and the NSW LPAB (chaired by NSW Chief Justice Tom Bathurst) confidence : Dan Tehan must intervene to protect students, and investigate TEQSA & NSW LPAB's approvals for Australia's first private ,non-university law school

by Ganesh Sahathevan

Zhu Minshen's Top Group has been of concern to investors from the time it was listed in Hong Kong, despite TEQSA, the NSW Legal Profession Admission Board and the Law Council Australia backing.

TEQSA and the NSW LPAB, which is chaired by the Chief Justice Of NSW, Tom Bathurst, once one of Australia's top commercial silks have all remained silent despite the Group's financial problems which persist (see story below).

It is now left to Commonwealth Minister for Education Dan Tehan to ensure that students are protected. In the process, he cannot but investigate TEQSA and the NSW LPAB's dealings with Zhu Minshen.

Zhu has stated publicly that the Law Council Australia also backed his law school, giving it offical approval. The LCA's backing also requires investigation.

TO BE READ WITH

Did You Manage To Avoid Top Education Group’s (HKG:1752) 25% Share Price Drop?

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Top Education Group Ltd (HKG:1752) share price slid 25% over twelve months. That’s disappointing when you consider the market declined 17%. Top Education Group hasn’t been listed for long, so although we’re wary of recent listings that perform poorly, it may still prove itself with time. Shareholders have had an even rougher run lately, with the share price down 11% in the last 90 days. Of course, this share price action may well have been influenced by the 15% decline in the broader market, throughout the period.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Top Education Group share price fell, it actually saw its earnings per share (EPS) improve by 58%. It could be that the share price was previously over-hyped.

It’s surprising to see the share price fall so much, despite the improved EPS. So it’s easy to justify a look at some other metrics.

With a low yield of 1.4% we doubt that the dividend influences the share price much. Top Education Group’s revenue is actually up 17% over the last year. Since we can’t easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

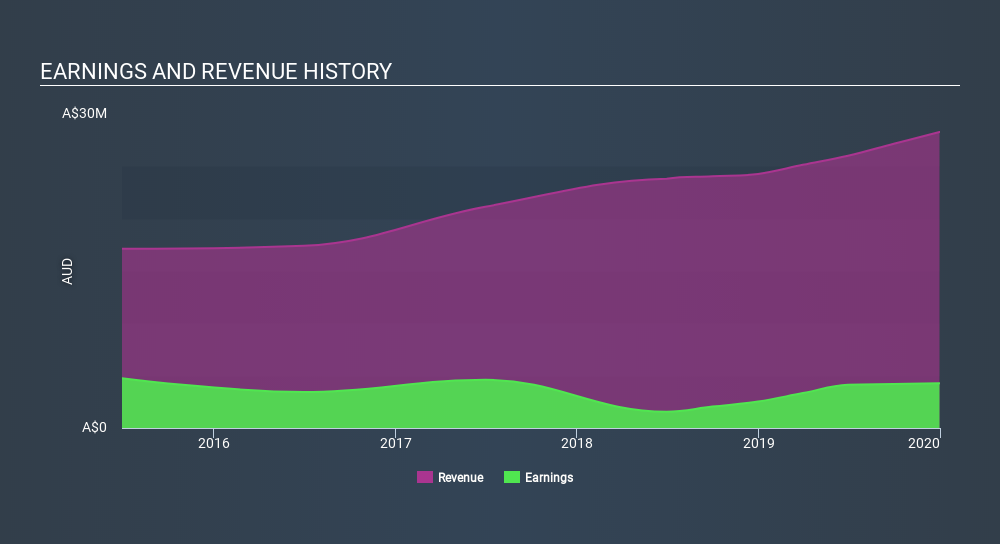

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Top Education Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We doubt Top Education Group shareholders are happy with the loss of 24% over twelve months (even including dividends) . That falls short of the market, which lost 17%. There’s no doubt that’s a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 11%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We’ve spotted 5 warning signs for Top Education Group you should be aware of, and 2 of them don’t sit too well with us.

If you would prefer to check out another company — one with potentially superior financials — then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Comments

Post a Comment